Hypocritical First-World Nations Want the Third World to Stay Poor

This is the third in a series of Impunity Observer articles (here and here) that expose the problems associated with applying the ESG framework to developing countries.

According to Reuters, ESG reports damage the ratings of the majority of developing countries: “The credit impact of ESG varies significantly … While for the advanced economies, we assess the credit impact to be ‘Neutral to Low’ for a majority, it is ‘Highly Negative’ or ‘Very Highly Negative’ for around 60 percent of emerging markets.”

This should be no surprise. The ESG framework is a progressive agenda that harms market prospects for both companies and national economies. Yet, it has managed to gain widespread traction. The number of ESG exchange-traded funds (ETFs) went from $12 billion in 2006 to $1,826 billion in 2023, an increase of over 15,000 percent! This result emanates from the perverse incentives of big companies in rich countries to toe the ideological line of the governments with which they collude.

World Economics country reviews include an ESG section. For developing countries, like Guatemala, World Economics touts that it has developed various indexes for the environmental pillar in particular, including CO2 emissions, a methane index, air quality, water access, and temperature.

Applying these standards to businesses in general, but to developing countries in particular, is just a dumb idea. Examples abound of the rich telling the poor how they should live and act to save the planet: advice that reduces to telling others not to do what they have done and intend to continue doing.

The discipline of economics defines luxury goods as things that people want when they have high incomes. The ESG framework goes further and amounts to luxury beliefs, as explained by Rob Henderson in the Wall Street Journal: these are “ideas and opinions that confer status on the upper class but often inflict real costs on the lower classes.” This applies both within rich countries and between rich and developing countries still aspiring to achieve prosperity. Luxury beliefs can be described as the often-nonsensical issues and policy proposals that rich countries can afford to entertain.

The Problems with the “Environmental” Pillar

The UN Development Program admits that not only the rich countries are expected to reduce their CO2 emissions; developing nations must also follow suit. Any developing-country government foolish enough to adopt this “developmental” advice in alignment with the ESG framework would be condemning its population to evermore high rates of poverty.

Real-world examples bring home the point. Many developing countries are tropical, with higher than average temperatures, yet the environmental pillar of World Economics gives low grades to developing economies based on their temperature index.

For example, under the World Economics ESG framework, Guatemala receives a score of 17.6 out of 100 on the temperature index—a very low score. However, the fact remains that there is nothing Guatemala could ever do to change its temperature, given its geographical location. Moreover, the question remains as to why Guatemala would ever want to do so. Guatemala’s temperature and general climate are pleasing, as any common tourist could readily affirm.

Further highlighting the silliness of the climate advice of the so-called experts, if the sum of CO2 emissions of not just Guatemala but all of the countries of Central America and the Dominican Republic taken together were reduced to zero, the impact on world emissions would be infinitesimal. Effectively, developing countries like Guatemala are being asked to sacrifice their prosperity in exchange for nothing.

Asking a developing country like Guatemala to reduce CO2 emissions is akin to asking it to renounce its aspirations of achieving prosperity in the same manner that today’s developed nations did. Today’s developed countries only became increasingly richer as they emitted progressively more CO2 per capita for over a century, as they underwent their industrialization processes. Freely available data from Our World in Data and the Maddison Project make it possible to calculate the descriptive statistics to support this affirmation.

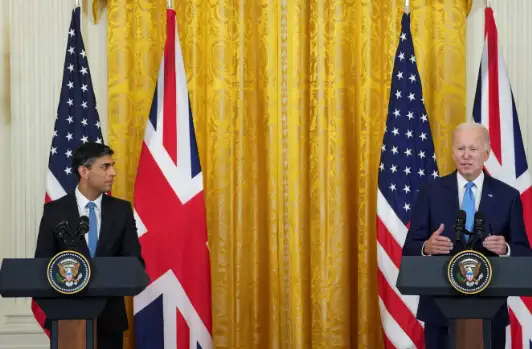

Two particular cases are illustrative: the United Kingdom and the United States.

For the United Kingdom, the birthplace of the Industrial Revolution, the annual data for GDP per capita (in price-constant terms) and CO2 emissions per capita are over 92 percent correlated between 1800 and 1940. For the United States, over the same period, the correlation is over 98 percent. With these rare levels of correlation, one could effectively substitute CO2 emissions per capita for GDP per capita as a measure of prosperity for countries still undergoing industrialization and growth.

Taking the analysis back to today’s developing countries, Guatemala’s correlation coefficient is 0.931 for the 1950–2022 period. As of the latest available data, GDP per capita in the United Kingdom and the United States are between eight and 14 times higher than in Guatemala, respectively, depending on whether one uses nominal or inflation-adjusted dollars. The divergence of riches between the “West versus the Rest” (Samuel P. Huntington’s term) still exists.

In short, it is counterproductive and hypocritical for developed countries as a whole, under the guise of the politically correct ESG framework, to pressure developing country governments to apply untested theories that they did not themselves consider, much less follow, in their developmental paths. Even Time magazine has published on the matter that the responsibility for sacrificing on the altar of climate should fall on wealthier countries, not those aspiring to develop.

The opinion of this article is foreign to Noticiero El Vigilante